utah county sales tax calculator

This is the total of state and county sales tax rates. The Utah County Utah sales tax is 675 consisting of 470 Utah state sales tax and 205 Utah County local sales taxesThe local.

The Utah UT state sales tax rate is 47.

. Depending on local jurisdictions the total tax rate can be as high as 87. Start filing your tax return now. Salt Lake City is located within Salt Lake County.

Utah has recent rate. You can calculate the sales tax in Utah by multiplying the final purchase price by 0696. Our free online Utah sales tax calculator calculates exact sales tax by state county city or ZIP code.

This includes the rates on the state county city and special levels. The current total local sales tax rate in Utah County UT is 7150. The average cumulative sales tax rate in Salt Lake County Utah is 761 with a range that spans from 725 to 875.

This includes the rates on the state county city and special levels. Our income tax calculator calculates your federal state and local taxes based on several key inputs. Utah has state sales tax of 485 and allows local governments to collect a local option sales tax of up to 335.

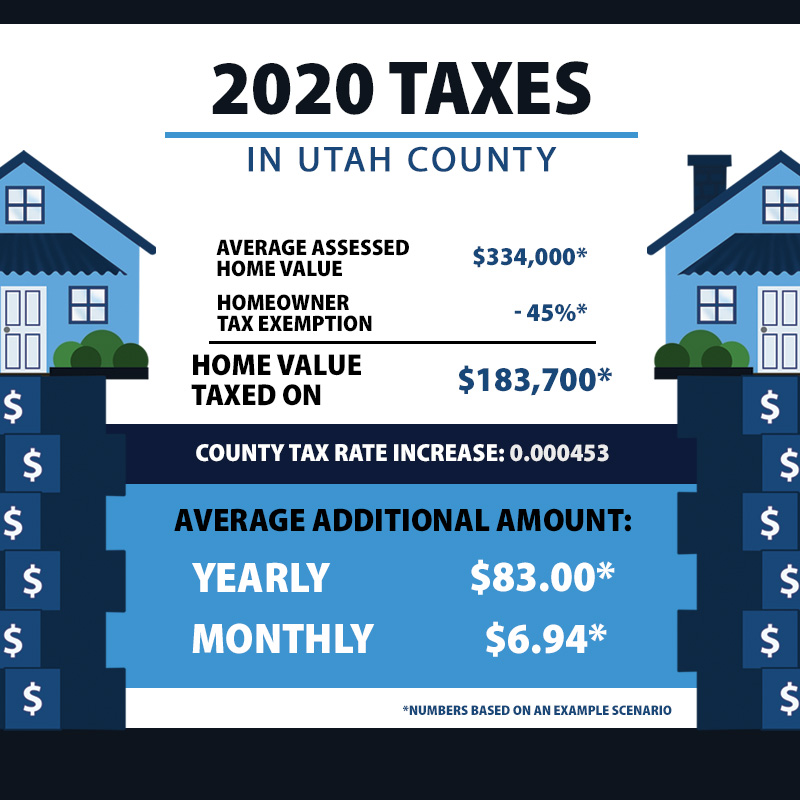

The December 2020 total local sales tax rate was also 7150. The average cumulative sales tax rate in Salt Lake City Utah is 76. What is the sales tax rate in Utah County.

Utah County Sales Tax Rates for 2023. Utah UT Sales Tax Rates by City all The state sales tax rate in Utah is 4850. Start filing your tax return now.

With local taxes the total sales tax rate is between 6100 and 9050. For example lets say that you want to purchase a new car for 30000 you would use. Our free online Utah sales tax calculator calculates exact sales tax by state county city or ZIP code.

The most populous location in Utah County Utah is Provo. Your household income location filing status and number of personal. Find your Utah combined state and local tax rate.

Utah sales tax rates vary depending on which. The Utah state sales tax. Local tax rates in Utah range from 0 to 4 making the sales tax range in Utah 47 to 87.

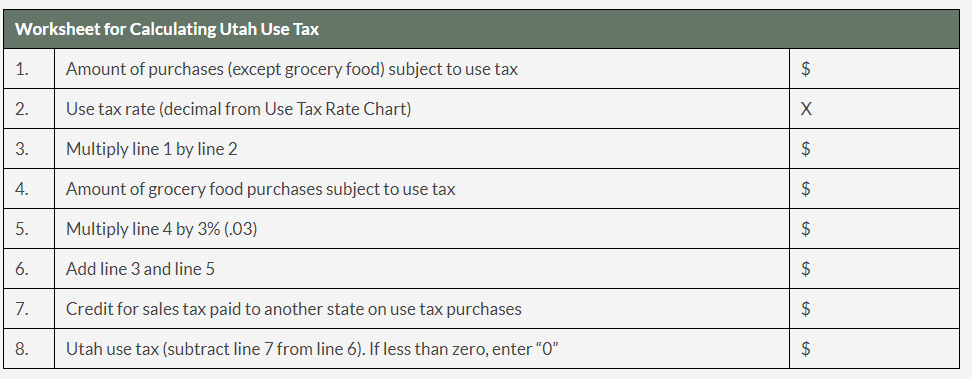

93 rows All Utah sales and use tax returns and other sales-related tax returns must be filed. Download all Utah sales tax rates by zip code. As far as other cities towns and locations go the place with the.

Local-level tax rates may include a local option up to 1 allowed by law. The average cumulative sales tax rate between all of them is 721. The minimum combined 2022 sales tax rate for Utah County Utah is.

If you need access to a database of all Utah local sales tax. Utah County in Utah has a tax rate of 675 for 2023 this includes the Utah Sales Tax Rate of 595 and Local Sales Tax Rates in Utah County totaling. The Piute County Utah Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Piute County Utah in the USA using average Sales Tax Rates andor.

2022 Utah Sales Tax By County Utah has 340 cities. Average Sales Tax With Local6964. There are a total of 127 local tax.

Or visit our Utah sales tax calculator to lookup local rates by zip code. The Utah County Utah Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Utah County Utah in the USA using average Sales Tax Rates andor.

Fuel Taxes In The United States Wikipedia

Car Tax By State Usa Manual Car Sales Tax Calculator

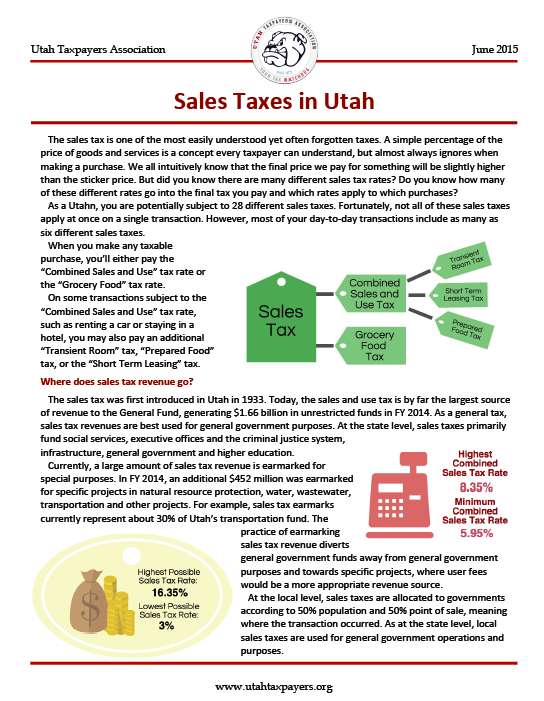

Sales Taxes In Utah A New Report From The Utah Taxpayers Association Utah Taxpayers

Utah Sales Tax A Policymakers Guide To Modernizing Utah S Sales Tax

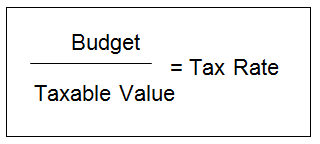

Tarrant County Tx Property Tax Calculator Smartasset

Car Tax By State Usa Manual Car Sales Tax Calculator

How Property Tax Works In Utah

Sales Tax Calculator And Rate Lookup Tool Avalara

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

Utah Sales Tax Guide And Calculator 2022 Taxjar

How To Pay Sales Tax For Small Business 6 Step Guide Chart

Utah Sales Tax Proposal Should Avoid Layering Taxes On Business Inputs

2022 Property Taxes By State Report Propertyshark

Property Taxes In Nevada Guinn Center For Policy Priorities

Las Vegas Sales Tax Rate And Calculator 2021 Wise

Property Taxes Went Up In These Utah Cities And Towns

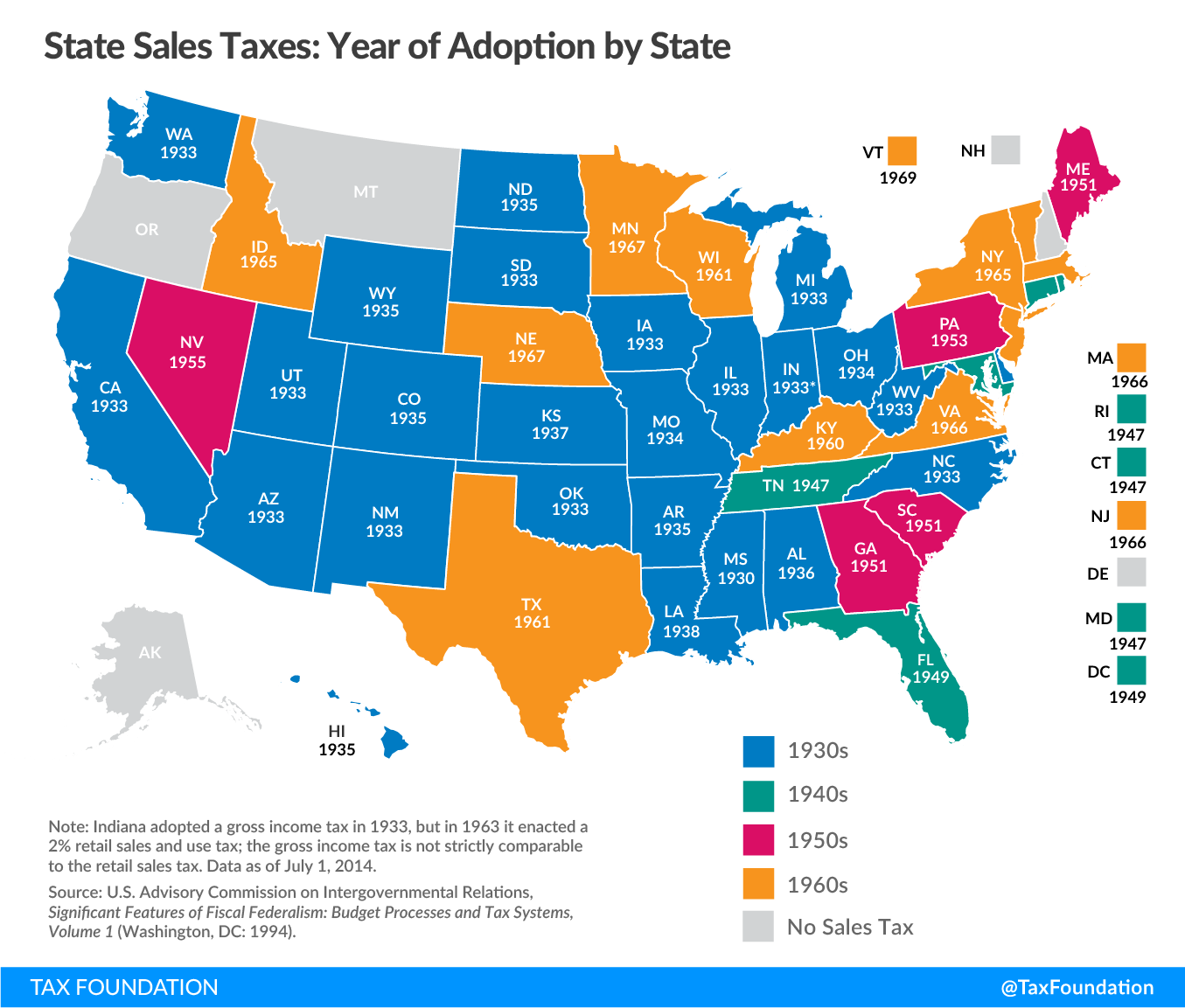

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation